NW Washington Home Buying and Selling Guide – Glossary

ADJUSTABLE-RATE MORTGAGE (ARM) - interest rates on this type of mortgage are periodically adjusted up or down depending on a specified financial index AMORTIZATION - a method of equalizing the monthly mortgage payments over the life of the loan, even though the proportion of principal to interest changes over time. In the early part of the loan, the principal repayment [...]

NW Washington Home Buying Guide – The Closing Settlement – Who Pays What?

During the negotiation stage of the transaction, a mutually agreed-upon date for closing is determined. "Closing" is when you and the seller sign all the paperwork and pay your share of the settlement fees, and the documents are recorded. Settlement obligations vary widely due to specific contract language, local laws and customs. Prior to closing, the closing agent (usually an [...]

NW Washington Home Buying and Selling Guide – Home Inspections

When you're ready to complete a purchase and sale agreement on a home, your offer will generally be contingent on a professional inspection of the entire property-including improvements. The home inspector looks beyond the cosmetics to make sure that the home's general systems operate properly. The inspector will also look for large repairs that are needed and report on the [...]

NW Washington Home Buying Guide – Closing Costs, Points, and Title Insurance

WHAT ARE CLOSING COSTS? Closing costs are charges paid to various entities during the real estate transaction. They can include escrow fees, document preparation fees, the cost of an inspection, and lender fees. WHAT IS A POINT? A point is equal to one percent of the loan principal. Some lenders charge points, in addition to interest and fees, at closing. [...]

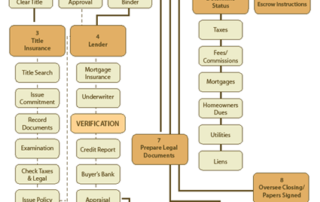

NW Washington Home Buying and Selling Guide – Understanding Real Estate Escrow Chart

Below is a Flow Chart of the Real Estate Escrow process. This chart is designed to help you understand the relationships between the various costs and fees involving purchasing a home. Click the image for a larger view.

NW Washington Home Buying Guide – Purchase and Sales Agreements

Once you've found the home you want to buy, together we'll complete a purchase and sale agreement. This is the contract in which you and the seller outline the details of the property transfer. The purchase and sale agreement usually consists of the following pages: Earnest money receipt Financing addendum Inspection addendum Conditions/disclosure addendum Contingency addendum-when appropriate Addendum outlining special [...]

NW Washington Home Buying Guide – How Much Home can I afford?

Before you start looking at homes, it's a good idea to find a target price range that you can afford. A mortgage lender will want to make sure you can qualify for the down payment, plus a monthly mortgage payment made up of principal, interest, taxes and insurance (PITI). Interest rates and your personal finances will influence the amount of [...]

NW Washington Home Buying Guide – Beginning the Process

Whatever your reasons for buying, finding the right home, in the perfect neighborhood, and at a cost that is within your budget, is no small task. We are licensed professionals. There are many benefits you receive from working with an experienced agent. Organization is the key to finding the home you want while spending the least amount of time and [...]